Risk and opportunities report

As a globally active company, the Würth Group is constantly exposed to risks, but also makes systematic use of opportunities that present themselves. Opportunities and risks can arise both as a result of our own actions or failure to act, and as a result of external factors. The risk and opportunities policy of the Würth Group is aimed at meeting the company’s medium-term financial objectives and at ensuring the sustainable, long-term growth of the Group. In order to ensure this, the Würth Group has a system that identifies entrepreneurial opportunities and risks, assesses them using a standardized system, weighs them against each other, and communicates them. Our conscious and systematic approach to addressing opportunities and risks is inextricably linked to our entrepreneurial activities.

How the risk management system works

The Würth Group has a three-tier risk management system (RMS), comprising the cyclical monitoring system of the Auditing Department, the Group Controlling Department and the early warning system. The Central Managing Board of the Würth Group holds overall responsibility for the Group-wide risk management process and defines the principles of our risk policy and strategy. Responsibility for the installation of a functioning and efficient RMS in the Group companies is the task of the management of each entity within the Group. They are supported by the risk manager, who reports directly to the Central Managing Board of the Würth Group and coordinates the risk management process at the Group level. The risk manager remains in close contact with the risk controller of the Advisory Board, who reports directly to the Chairwoman of the Advisory Board.

How the internal control system for financial reporting works

The aim of the internal control system for financial reporting is to ensure that all business transactions are completely recorded and correctly evaluated with regard to the financial reporting requirements.

The Würth Information System is an integral component of the internal control and risk management system of the Würth Group. With the help of this reporting system, all key performance indicators required to steer the Würth Group are presented in a timely manner and are available for further evaluation by the Central Managing Board and Executive Vice Presidents, based on standardized monthly reporting.

System-based control mechanisms such as validation and cross-checks optimize the quality of the information as a basis for decision-making. A Group-wide online record of the financial statements of the Group entities is not only efficient, it also avoids carry-over errors, safeguards the uniform provision of information and includes numerous plausibility checks, without which the information cannot be forwarded. This platform also ensures that financial reporting changes are implemented in a uniform manner across the Group. Data is protected from changes by using check digits and a system of IT access rights. Standard software is used for consolidation. Changes in the system settings are logged centrally. The monthly and annual financial statements of Group companies are subject to regular automated assessment mechanisms, as are the consolidated financial statements. Moreover, Würth’s Policy and Procedure (PAP) Manual contains internal procedural instructions. Internal publications and training include detailed rules on financial reporting. Compliance with these rules is regularly reviewed by the Auditing Department. External specialists are consulted to clarify the implications of legal and tax issues on accounting. External actuaries calculate pension obligations and similar obligations. Central and local training courses for those in charge of finance departments also ensure that all employees involved in the financial reporting process are up to date on the latest legislation and information of relevance to them.

The opportunity and risk management process is updated within the Würth Group on an ongoing basis and adapted to changes in the Group or in its economic and legal environment. In the 2018 fiscal year, the establishment of the IT-based risk reporting system was continued at further Group companies and the Executive Vice Presidents and heads of the Group’s administrative departments were actively involved in the risk management process.

Risks

The Central Managing Board identifies, analyzes and assesses the Group’s opportunities and risks at a dedicated annual workshop. This workshop determines focus risks that could pose a threat to the net assets, financial position and results of operations of individual entities or the Würth Group as a whole in the short, medium or long term. Furthermore, with the support of the Risk Manager, all major Group entities carried out a risk inventory and recorded and assessed focus risks and other risks in the reporting system. The processes already in place were continued in 2018, undergoing further improvements and adjustments in line with changing internal and external requirements.

Major risks that can be insured on an economically reasonable scale are covered by Group insurance programs for all Group entities whenever possible. In 2018, we were able to continue the integration of the separate credit insurance policies taken out by the individual Würth entities into master policies with various credit insurers. This allowed us to expand and standardize our insurance coverage and achieve cost advantages at the same time. In addition, receivables from customers are monitored by an extensive receivable management system, also at the Group level. Individual financial service providers are associated with a heightened risk of default. We counter this risk through a strict credit verification procedure and appropriate insurance for our investments. Collection days are still at a very good low level. This highlights that our risk in this area is relatively low and that the existing processes and systems are effective. We believe that other risks in Germany lie in the applicable insolvency challenge rights, which grant insolvency administrators extensive opportunities for reimbursement if we have supported our customers with generous payment terms in the past. This risk has not been reduced to any considerable degree even after the reform of the insolvency challenge rights. We have, however, been able to take out an insurance policy to cover such reimbursement claims to protect all German companies against unforeseeable risks in this area. Overall insurance coverage is managed centrally.

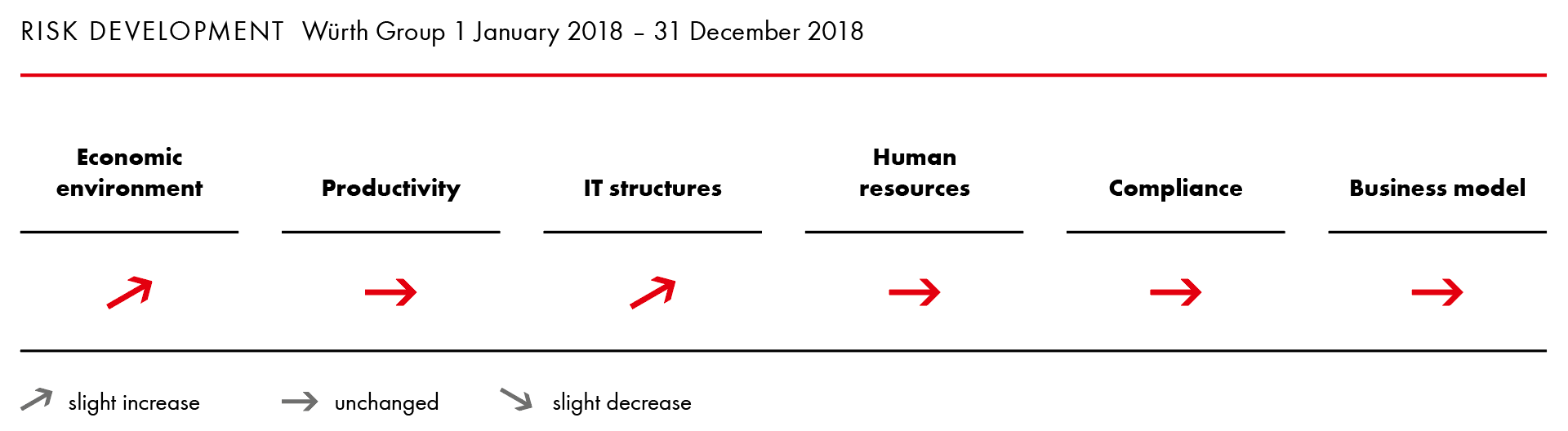

The Central Managing Board has identified potential risks that could have a negative impact on the net assets, financial position and results of operations of the company in the following risk areas, sorted by descending relevance:

Economic environment

Through our global purchasing and sales activities, we have a high natural diversification of risk and a decreased dependency on negative economic developments in individual countries, with more than 80 percent of our sales being generated in Europe. This means that we are affected to a particular degree by economic fluctuations in the eurozone. Our companies in Southern Europe, for example in Italy and Spain, are exposed to an increased risk, although this situation continued to improve in the course of last year. We believe that other risks lie in political developments in Eastern European markets and in Turkey, as well as in the increasing trade barriers between China, the USA and Europe. We believe that the immigration to Europe not only poses economic and social challenges, but also still presents opportunities for the labor market and on the demand side for our customers and, as a result, for the Würth Group. We believe that the rise of right-wing populism and isolated plans to reverse globalization trends within individual countries give cause for concern, although we have not identified any immediate threat to our business objectives for 2019 as yet.

Most of the financial risks of the Würth Group are measured, monitored and controlled centrally by Würth Finance International B.V. With liquid assets of EUR 493 million and a committed, unused credit line of EUR 400 million running until July 2023, the Würth Group has sufficient liquidity reserves to meet its payment obligations at all times. Thanks to its “A rating” from Standard & Poor’s, the Würth Group has excellent access to the public and private capital markets to procure further financial resources. Any risks arising from derivative financial instruments are accounted for. At the time this management report was prepared, there was no indication of any specific counterparty risks, which are automatically monitored on a daily basis. A CSA (Credit Support Annex) is in place with the main counterparties to derivatives, thus further reducing counterparty risk. Cluster risks are avoided by internal deposit limits for individual banks. For a description of derivatives and associated risks, please refer to the notes on the consolidated financial statements under I. “Other notes”, [4] “Financial instruments”.

Productivity

Every year, the Würth Group invests an amount running into the mid triple-digit million range to secure its planned sales growth and further expand its market shares in individual regions / market areas. As a result, any deviations from the planned route require a timely response, with targeted measures to counteract such developments. These measures include management using key productivity figures, the in-depth analysis of loss-making companies, a detailed, multi-stage investment controlling process, scenario calculations and a firm focus on achieving the targeted operating results. As a general rule, we take care to ensure that sales and gross profit grow faster than personnel expenses—in line with one of the Würth Group’s fundamental principles: “Growth without profit is fatal.”

IT structures

Due to the decentralized organizational structure of the Würth Group, with a large number of companies and different business models and requirements, IT structures are a particular challenge. The Würth Group rises to these challenges with a clear strategy for the global standardization and harmonization of its IT structures.

IT standardization

The central management of the IT companies with what is now a standardized product portfolio allows us to reflect the international multiplication strategy in our IT systems, too. Further standardization is achieved in line with a roll-out plan that sets out the launch dates at the individual companies, with numerous roll-out teams working on the introduction of the components in question in parallel to ensure a broad multiplication platform for the individual applications, processes and functions.

The roll-outs will make existing processes more uniform, more efficient, more transparent and faster. This will allow the individual companies to respond to the rising demand for individual ordering and delivery services among our customers. Efficiency gains can still be achieved, as the standardization of the IT structures through central development will result in economies of scale.

The Würth Group’s IT service has proven its ability to perform in line with the very highest standards. The uniform system platforms will allow further developments to be made available to all companies working on the platform in question within a very short period of time.

IT security

The security of the IT systems is reviewed by means of IT checks at the Group entities in accordance with a plan coordinated with the Central Managing Board. We analyze and monitor the potential threat that cyber risks pose on a regular basis. We combat the resulting risks by taking organizational and technical measures and also by transferring risks that can be insured to external risk carriers, such as insurers. All measures relating to data security and IT risks are taken in cooperation with our Data Security Officer, who is responsible for the entire Group. In addition, Würth has now introduced an IT Compliance Code of Conduct and appointed an IT Compliance Officer. The network of IT security officers in the companies is used to take measures to ward off security risks quickly at the level of the Group companies and establish those measures with regard to the continuous improvement of IT security. The centralization of the IT systems also allows far-reaching and multi-level security procedures to be implemented, both at the physical level, for example in the data centers, and at the logistical level, for example in the various system and program components.

Human resources

Staff turnover, particularly among our sales force employees, remains a focal point. This is documented and analyzed across all hierarchy levels for every entity within the Würth Group. Regular employee surveys conducted by independent institutions and the monthly monitoring of staff turnover are key tools that allow us to identify unfavorable developments, analyze their impact on staff recruitment processes, customer loyalty and training programs, and combat these effects using targeted measures. The overall staff turnover rate of the Würth Group remains at a very encouraging low level at well below the 20-percent mark. The lack of specialist employees to work as members of the in-house staff or the sales force is another challenge for HR management. For many companies, it is becoming increasingly difficult to find university graduates and skilled trainees. This prompted us to further expand the activities of Würth Business Academy for the in-house staff and the sales force when it comes to training management employees and new management talent. Up-and-coming management talents partake in development courses to prepare them for various levels of management within the Würth Group via the MC Würth, High Potential and Top Potential training programs. These programs give employees targeted training that is tailored to suit their own individual ambitions and skills in order to prepare them for further management duties within the Group. In addition to management seminars, international specialist seminars on issues such as product management, procurement, logistics and finance are organized and coordinated by Würth Business Academy in order to support the specialist functions with relevant further training.

In order to ensure that the process involved in providing all central functions of the Würth Group with up-and-coming management talent is structured and targeted, two processes are gradually being introduced with binding effect at larger companies: The Management Assessment Process (MAP) is the qualitative the tool used for the objective and standardized evaluation of executives. The talent management system is used to identify whether there is a sufficient number of qualified successors for functions that are relevant to the success of the Würth Group companies and, if not, by when these successors need to be available. All up-and-coming management talent is included in this system as well, in order to ensure a structured and transparent development process.

Compliance risks

National and international transactions involving goods, services, payments, capital, technology, software and other types of intellectual property are subject to numerous regulations and limitations that also have to be observed by the companies in the Würth Group. There is no question that we aim to comply with all regulations and administrative requirements for our business, both nationally and internationally. This applies when dealing with our customers and suppliers, employees, competitors, other business partners, and public authorities. Due to increasing legal complexity, we have in-house experts and consult renowned external consultants on a case-by-case basis. Particularly in emerging markets such as Brazil and China, complex, inconsistent and constantly changing legal principles pose a challenge and also create risks that are difficult to assess and will persist in the long term due to the possibility of retroactive effects.

Value-oriented corporate culture

Mutual trust, predictability, honesty and straightforwardness both internally and externally are fundamental principles that are deeply ingrained in Würth’s corporate culture. Our commitment to these values can be found as far back as the corporate philosophy penned by Reinhold Würth back in the 1970s.This does not just entail adhering to all applicable laws and in-house regulations, but also means ensuring that employees maintain the proper mindset, which forms a key component of the sustainable corporate success of the Würth Group. Extensive internal guidelines known as the “PAP” (Policy and Procedure Manual) operationalize these fundamental principles in the form of descriptions of the structure and process organization, as well as setting out specific rules and codes of conduct.

Compliance organization

With regard to the mounting requirements that compliance organizations have to meet at both the national and international level, the Central Managing Board made the decision in 2015, with the consent of the Advisory Board and the Supervisory Board of the Würth Group’s Family Trusts, to combine and restructure the existing compliance components to form a Group-wide compliance management system and considerably strengthen the compliance organization. In addition to the role of Chief Compliance Officer and Group Compliance Officer, compliance officers were appointed at the level of the units, and additional compliance officers were appointed within the largest individual companies in the Würth Group during the 2016 fiscal year. The responsibilities and structures for product, tax and IT compliance that are already in place across the Group will remain in force, but will also report to the Chief Compliance Officer of the Würth Group in the future. A newly created Compliance Board will provide advice on compliance incidents as and when required and will make recommendations regarding any measures that need to be taken. The Compliance Board will also be responsible for the further development of the compliance organization and will report to the Central Managing Board and the Advisory Board of the Würth Group in all compliance matters.

Compliance regulations revised and supplemented

In addition to these structural changes, the internal guidelines on matters relating to compliance were also revised and supplemented. The fundamental features of the corporate philosophy were summarized once again in the Code of Compliance and supplemented with regard to compliance with international standards. In order to anchor the new compliance organization within the Group in the long term, Group-wide training sessions on the new compliance organization and on compliance issues have been conducted since the 2016 fiscal year. Training sessions will initially focus on “Dealing with gifts and invitations”, “Antitrust law and price fixing”, “Company secrets”, “Data protection,” “European General Data Protection Regulation” and “Export control”.

Group-wide reporting system

The existing hotline that can be used to report suspicions of compliance breaches is being replaced by a Group-wide reporting system. This means that not only employees but also customers, suppliers and other individuals will be able to report any suspected compliance breaches directly to the Würth Group’s Compliance Office. The use of a technical system made available by an external service provider means that reports can be submitted completely anonymously.

Prerequisite for sustainable corporate success

The restructuring of the compliance organization was motivated by the firm conviction of the Central Managing Board, the Würth family, the Supervisory Board of the Würth Group’s Family Trusts and the Advisory Board that a living and breathing compliance culture will play a key role in ensuring the further sustainable success of the Würth Group. At the same time, the management teams of the Group companies can proactively live up to their responsibility with regard to the mounting national and international demands that compliance organizations have to meet.

Business model

The business model of direct selling still offers considerable opportunities for the Würth Group in that it places us very close to the market and ensures customer loyalty. Nevertheless, customer ordering behavior has changed considerably in recent years. The Internet offers a whole host of opportunities for working directly with suppliers. The relative ease with which businesses can establish Internet-based business models is resulting in growing competitive pressure. Our business model has to adapt to reflect this development. We want direct sales to continue to play a key role but also want issues such as logistics and a broad product range to enjoy market opportunities. Nowadays, sales representatives are more than just salespeople. They are managers of various different customer contact points: the sales force, branch offices and the Internet. We refer to this as a multi-channel sales model in which e-business serves as a practical complement to the traditional sales methods in a manner that is tailored to suit our customers’ procurement organization. The above-average increase in e-business sales in 2018 shows that we are on the right track with the developments and services that we are offering with our customers’ needs in mind, and that our strategy of multi-channel sales is bearing fruit.

Opportunities

The opportunities set out below could have a positive impact on our net assets, financial position and operating result. The opportunities are also listed in decreasing order of relevance.

Decentralized structure

Würth’s decentralized structure is a great advantage for the Group, especially in light of the fact that the individual countries in which we operate display such variation in their economic development. We believe that this structure presents an opportunity for future growth. It allows for a quick local response to circumstances and changes in any given market environment, meaning that we can implement efficient measures. We will continue to push the development of the Würth Group while maintaining our decentralized structure. The term “decentralized”, within this context, not only refers to regional aspects, but also covers our large number of different business models. However, the fact that we pursue the principle of decentralization does not mean that we cannot standardize processes where it makes sense to do so in order to make more efficient use of our resources.

Market penetration

Our global share of the market is estimated at just five percent due to a low share of the market in most countries, with a few exceptions. What would appear to be a disadvantage actually signals major growth potential that we can tap into by further expanding our customer base and intensifying our customer relationships, for example, by continually enhancing intelligent distribution systems that offer real benefits to our customers.

Customer relations

Our more than 3.6 million customers form the basis for our business success. As a result, expanding and maintaining our customer relations are key components of our day-to-day work. We will continue to focus on very intensive customer management at all Group companies. Around 300,000 customer contacts a day and a large number of long-standing relationships between our customers and our 33,000 sales representatives help us to exploit the existing customer potential to the greatest extent possible. Grouping our customers based on their individual needs is a key control mechanism for strategic management. Our motto is: “To each customer their own Würth.” The correlation between additional customers and sales growth, together with the service level, are important indicators of business success for us. Customer insolvencies are a manageable risk for the Würth Group. Thanks to our very extensive core range of 125,000 products, the comparatively low average order values and the broad customer base, we are well placed to keep the risks low.

Quality

It is the declared aim of the Würth Group to meet, or where possible exceed, the highest quality standards. For this reason, the guiding principle “Würth is quality—everywhere, every time” was anchored in the Würth Group’s quality management back in 2010 and consistently developed further in the years that followed. The brand promise made by this principle applies to all of our markets, and its implementation opens up important additional market opportunities. This is true both of customers in the professional trades and those in industry. For us, ensuring reliable compliance with standards, in addition to fulfilling product requirements and approval criteria, is a fundamental quality management task to enable us to be a dependable partner for our customers. This is important, but we do not consider it enough in and of itself: We strive to surpass customer expectations wherever possible with our services and inspire our customers in the process.

In the 2018 fiscal year, the Würth Group’s central quality team continued its activities. The Group-wide Würth Quality Risk Company Assessments (QRCA) identify strengths and potential for improvement and arrive at future measures based on these findings. A total of 355 QRCAs had been conducted by the end of 2018. The management of the respective company directly implements the findings in specific process enhancements. The measures prioritize customer interfaces (contract review, sales support), complaint management, warehouse batch management, quality assurance, and supplier management, with additional employees being hired in this area, too.

Key components of the Würth quality promise include, first of all, the validation of new products by the quality department, e.g., at Adolf Würth GmbH & Co. KG and Würth International AG, and, secondly, measures to safeguard the quality of delivery by conducting supplier training and systematic checks along the supply chain. The Würth Group now has over 24 active “Supplier Quality Engineers” (SQEs) as well as over 20 test laboratories / goods checkpoints spread across Europe, the US and Asia with a total of over 120 employees. By the end of the reporting period, five test laboratories had been awarded ISO 17025 accreditation. Further investments were made in the expansion of the global SAP-supported system for advance quality planning and the verification of tests and in the further integration of Group laboratories and suppliers.

The training initiative in quality management was also continued. The target group is employees from quality assurance. A further 299 employees were trained in quality management, assurance and auditing in 2018. In addition, an international quality and purchasing conference was held in June 2018 with 220 participants from Germany and abroad focusing on the digital supply chain.

Overall assessment

The risks for the Würth Group are limited by the established and functioning risk management system. Existing risks are consistently monitored and assigned measures to ensure that they do not jeopardize the Würth Group’s continued prosperity. We are currently not aware of any such risks. The existing opportunities will enable us to continue growing profitably in 2019 and the years to come.